The idea of dealing with cryptocurrency taxes has always been as confusing as it is intriguing to the Indian market. Clear rules and protocols for tax on stocks and property have been in place for the market to follow, but such provisions for cryptocurrencies still seem to be as amorphous as ever. There is an enormous amount of confusion and uncertainty about the current cryptocurrency laws and the introduction of possibly unfavorable laws in the future.

The unfortunate reality of this country is that the general population is more likely to buy into the hype and mainstream perception of laws as opposed to the actual laws. While the RBI had merely restricted banking access to cryptocurrency entities, the Indian population assumed the RBI had declared cryptocurrencies illegal. In any case, if you’re profiting from cryptocurrencies, you ought to pay taxes for the same. You will need to use a cryptocurrency tax software for the same.

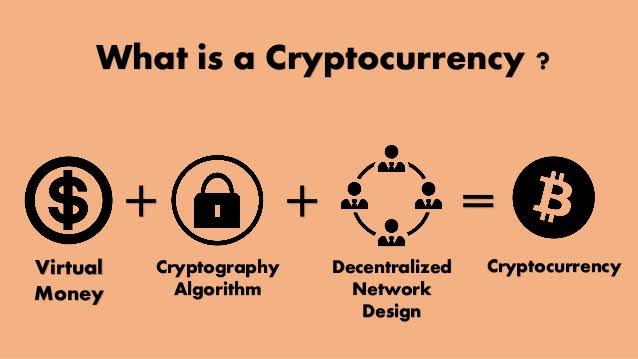

What is a cryptocurrency?

In a nutshell, cryptocurrency is an internet-based medium of exchange that uses cryptographic functions to carry out financial transactions. Based on block-chain technology, its most prominent characteristic is the absence of a central entity.

Generally, a central server is put in place to ensure that there is no double-spending between the two parties in a payment network. However, in a decentralized network like this, there exists no such server. Therefore, each entity in this peer to peer network is required to have a list of all the transactions to make sure the future transactions are valid. Transactions happen when the private key of the sender signs them. Once the private key signs the transaction, it is broadcasted to the entire network and sent from one peer to the next.

For example, if you were to send bitcoins to your friend, your private key would have to sign the transaction for it to happen.

How risky is it?

Any reasonable person is bound to ask this question given how new and confusing cryptocurrencies seem to be. Cryptocurrencies have a few critical characteristicsthat are entirely different from the real world currencies that the general population is used to.

Irreversible: Once the transaction is confirmed, it cannot be reversed by ANYONE. You cannot contact your bank or any other entity to reverse your transaction. In other words, there is no safety net.

Pseudonymous: Cryptocurrencies or accounts cannot be traced back to their real-world identities. You receive bitcoins on addresses that are chains of 30 characters. It is possible to analyze the transaction flow but not determine the real-world identities of the accounts in question.

Safe and Secure: The transactions may be irreversible, but they are undoubtedly secure. The owner of the private key is the only entity that can send cryptocurrencies. It is impossible to hack the system due to the immensely complex cryptography system.

No permission required: Since there is no centralization whatsoever, you do not need permission to use cryptocurrencies. You can download the software in a matter of minutes and send or receive bitcoins or any other currency of your choice. In other words, there is no gatekeeper.

Value and Scope

Being the irreversible, pseudonymous, and secure means of payment that cryptocurrencies are, they are entirely independent of political or government influence. This means you can’t prevent someone from using bitcoin (or any other cryptocurrency) just as you can’t reverse a signed transaction. The emergence of bitcoin paved the way for the dawn of a new economy.

Cryptocurrencies are said to be digital gold. Cryptocurrencies are money independent of politics and promise to increase their value over time. It should not surprise you that people all over the world are buying into cryptocurrencies at an increasing rate to protect themselves from the devaluation of their respective national currencies, especially in Asia. As you may have gathered, cryptocurrencies have their own merits and demerits and in turn, are as risky as they are rewarding, depending on how you choose to look at it.

Regardless, cryptocurrencies are here to stay and irrevocably change the economy. You can decide to be a part of this revolution or stand on the sidelines. However, if you’ve decided to take the plunge and dive headfirst into the world of cryptocurrencies, you ought to know how they’re taxed.

How are cryptocurrencies taxed?

Cryptocurrencies are treated as property, not currencies. In other words, they are subject to capital gains and losses similar to the various forms of property. If you buy a bitcoin at a particular rate and sell it at a profit after a few months, your bitcoin is now taxable. You can calculate the taxes on Bitcoin capital gain by using bitcoin tax calculator from Zenledger. You do not owe any taxes as long as you don’t sell or trade your cryptocurrency. Taxable events are also triggered when you perform crypto to crypto trades. You will need to report your taxes just like you would when you sell your cryptocurrency.

However, the capital gain or loss calculations on crypto to crypto trades are more complicated than regular cryptocurrency sales because your trades are not quoted in FIAT currencies.

The need for Cryptocurrency Tax Software:

Calculating cryptocurrency taxes is an arduous task for most people. Its complexity only increases with the increase in the number of trades or transactions. Fortunately, there exist various cryptocurrency tax software that you can use to make your life infinitely easier. Cryptocurrency tax software can also be used to generate crypto tax reports. The following is a list of the most popular cryptocurrency tax software:

Token Tax

Bear Tax

Cryptotrader.tax

ZenLedger

CoinTracker

As cryptocurrencies gain popularity globally, it is a good idea to know all you can about how it might be taxed in India. This will help you stay ahead of the curve and can save you a lot of trouble and confusion when it does eventually come to India.