Credit cards are one of the most useful entities in today’s time. Almost every individual at present owns one and continues to learn new things about it with time. At the same time, credit cards can often be confusing too. If you use a credit card, there are certain things you must understand about its appropriate usage. This article will serve as a guide to the do’s and don’ts of using a credit card. If this sounds helpful, read on!

First, we will be discussing the things that should be done when using a credit card. These steps can greatly benefit you as a credit card user in the long run.

Here’s What You Should Do as a Credit Card Owner

1. Keep Yourself Updated With the Due Dates

One of the first things you need to keep track of is the due date on your bills. Failing to pay your bills on time can be detrimental to your credit score. This is even more so if you have more than one bank account. While you can contact your bank’s customer support team and change your due date, it’s best to set a reminder for it. This can go a long way in preventing you from making delayed payments.

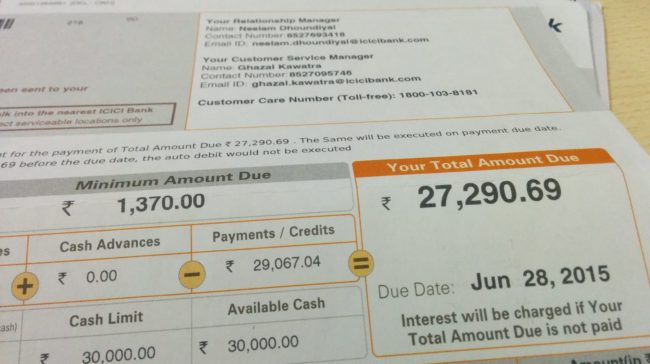

2. Go Through Your Credit Card Statement

An important thing to do when using a credit card is to go through its statement of transactions every month, regardless of the use of autopay or paperless billing. Your statement gives you a detailed view of all your transactions, which can be great when tracking fraudulent payments, interest deductions, etc.

3. Credit Card Payments Should Be 10% of Your Income.

As a good rule of thumb, try keeping your credit card payments up to 10% of your total income. Anything more than this could be financially draining, and can also lead to delayed payments if you’re unable to cough up the required sum. However, you can spend as much as you like in times of need. Such self-control will help you make better monetary decisions in the future, which will positively reflect your credit score.

4. Pay More Than the Minimum

Always try paying more than the minimum charges on your bill. By doing so, you stand a better chance of clearing your debt quicker, which will also lead to less interest on your payments. However, the entire concept of minimum charges is correlated with maximising the profits of credit issuers. Therefore, it’s best to pay more than the minimum amount required. This will also ensure that you’re using less credit, which positively reflects on your report.

5. Credit Age

Another major thing to consider when using a credit card is the credit age. The longer you ha keep your accounts open, the better it is for your score. In short, an older account helps increase your credit score. Thus, make sure to manage your account efficiently after opening it, and once it’s opened, try to make small purchases to keep it active even if you’re not an avid credit card user.

Here’s What You Shouldn’t Do as a Credit Card Owner

As we mentioned in the previous section, it’s essential to avoid certain practices as a credit card owner. Not only will this help you comprehend all the things that you have been doing wrong, but it will also help you to improve in such future situations.

Here are some of the don’ts of using a credit card:

1. Don’t Miss Your Payments for More Than 30 Days

This is the most important thing to avoid when using a credit card. You must avoid missing any payments for more than 30 days. If you forget to make your payments within 30 days, or before the stipulated deadline, it negatively affects your credit and gets recorded in your Equifax credit report. Any delayed payments stay on your report for seven years. Therefore, you mustn’t miss out on any payments and clear all your dues well within the deadlines.

2. Do Not Apply Too Much in Six Months

Each credit card application leads to a hard inquiry on your credit report, thus negatively affecting your credit score. You have to refrain from applying for credit cards or loans for bad credit no guarantor too often. Also, applying for multiple credit cards can increase your debts over time as paying their bills and renewal fees can be burdensome if you’re not careful with your expenses.

3. Do Not Make Rash Credit Card Applications.

Do not open an account simply because you’ve received a proposal or offer to open one in your mail. You should always thoroughly research the card and compare it with others before making a decision. Likewise, make sure that the card is affordable and that you will actually use it; there is no point in opening an account if these criteria are not met. Always try to avoid opening any random accounts. Check your email, but do not fall for account proposals all the time. You may end up opening more than necessary accounts.

4. Do Not Take Any More Credit Than You Can Repay

And lastly, if you are a person who takes more credit than you can repay, you must put a stop to this practice. Always take credit that is within your income, as taking more than you can afford makes it difficult to repay and can lead to delayed payments and a reduction in your credit score. When you take out a loan, lenders keep a thorough track of debt-to-income ratios. However, when taking credit, it’s not the same. Although taking credit is pretty easy, clearing the bills is not. So, taking more than you can afford is never advisable.

Conclusion

To summarise, these were some of the do’s and don’ts of using a credit card. The above-mentioned points will surely help you maintain all your accounts effectively without damaging your credit score. We hope you found this article helpful, and that you’ve understood how you can manage your credit cards better.