This post will show you the OlympusDAO review.

USDT AND USDC are stable coins pegged to the dollar. This means that they are also plagued by inflationary tendencies affecting fiat currencies. OlympusDAO tries to address this problem by creating the OHM token to function as reserve currency backed by decentralized digital assets held in the Olympus treasury.

The OlympusDAO project aims to solve the dependencies and risks of the fiat monetary system associated with stable coins pegged to fiat currencies.

Will the OlympusDAO provide a solution for the fiat inflationary tendencies plaguing stable coins? This review will focus on the OlympusDAO and its potential to solve real-world economic issues.

What Is OlympusDAO?

The OlympusDAO project is a Decentralized Autonomous Project launched in March 2021 by an anonymous group. The OHM is not a stable coin but is designed as a reserve currency backed by several digital assets.

Hence, it will possess the attributes of stable coins, but like Bitcoin, without the inflationary tendencies affecting fiat currencies. Unlike Bitcoin, the digital assets backing the OHM token will protect it from volatility by protecting the OHM against sharp price falls.

How Does OlympusDAO Work?

The priority of the OlympusDAO protocol is to stabilize the price of its OHM tokens. The network protocol does this automatically by monitoring the real market price of the OHM token.

The OlympusDAO keeps the price of the OHM token stable by directly buying and burning OHM tokens from the market if the price of the OHMs token falls below its RVF (Risk-Free Value). On the other hand, if OHM’s goes above its RSF, the protocol automatically mints and release a new OHMs token into the market to drive down OHM’s price.

The OHM is backed by digital assets like DAI, FRAX, OHM-DAI LP tokens, and the OHM-FRAX LP tokens. It is hoping to have more digital assets in its reserve.

OHM’s Floating Market Price

You should note that the price of OHM is ‘backed’ by the DAI and other digital assets; hence its value is not pegged to a currency; rather, it is determined by the volume of assets backing each OHM. This value is known as the Risk-Free Value (RFV).

The OHM’s RVF determines its intrinsic value; it is nevertheless subjected to the demand and supply forces operating in the market. At the time of writing, the OHM token has a market price of $1,180.56, a price far above its RVF.

OlmypusDAO De-Fi Products

There are two ways by which the OlympusDAO increases its supply of the OHMs token in circulation; it does this by staking and burning.

Staking

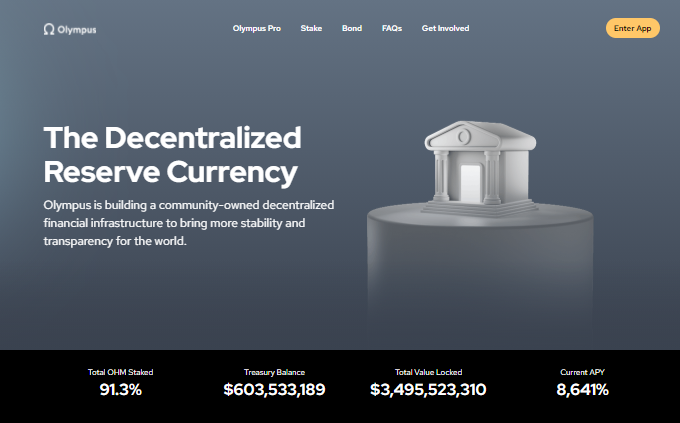

OlympusDAO issues new OHM tokens via staking. Holders who stake their OHM tokens are rewarded with new OHM tokens. Presently, 91.0% OHM coins are staked with a net yield of 8,788% making it a risk-free high-yield investment tool that protects investors from capital erosion should the market experience price dips.

A staking yield of 8,788% may be sustainable; however, a Glassnode analysis shows that OHM can pay more than 40,000% as APY.

Investors who staked their OHMs receive new OHM tokens in the form of sOHM; this makes you a stakeholder with voting rights to vote for or against a project.

Bonding

OlympusDAO bonding works by accepting digital assets from investors in exchange for OHM tokens. Bonding offers a higher yield than staking, hence, acting as an incentive for investors to exchange other digital assets for OlympusDAO’s native token.

Bonding is a means by which OlympusDAO increases its RVF by expanding its digital assets backing the OHM token. Aside from growing OHM’s reserve, Bonding also provides unlimited liquidity for OHM since it helps OlympusDAO own its liquidity, therefore, being in control rather than giving control to liquidity providers.

Additionally, Bonding gives OlympusDAO the ability to offer significantly high yields for its staking protocols since it reaps the benefits that come with being a liquidity provider. (OlympusDAO provides more than 95% of the OHM-FRAS pair liquidity on Uniswap and OHM-DAI pair on SushiSwap). This has also led to a significant reduction of trading fees associated with LP staking.

The Future Of OlympusDAO

OlympusDAO is a new project less than a year old; it shows promising signs in tackling issues bedeviling stable coins. It also provides a lucrative way for investors to grow their capitals risk-free by using several digital assets as reserves, partnering with other DeFi projects, and acting as a liquidity provider for notable exchange sites like Sushi and Uniswap.