Ripple and XRP are enjoying a successful year and more recognition with each passing day. The two entities are mainly popular for facilitating cross-border payments which are safer, cheaper and also almost instant.

Ripple has been working to eliminate SWIFT’s flaws. As you know, SWIFT is the traditional payments system which has been used by banks and financial institutions for decades now, but it seems that it failed to keep up with all the tech innovations and evolution.

This lead to banks ditching the system for the benefits offered by Ripple’s products. You may recall Euro Exim Bank which dropped SWIFT after they lost one of their transactions and got on board with Ripple instead.

Anyway, VISA has been working on its own solution, which seems to hold enough potential to challenge Ripple.

VISA introduces B2B Connect

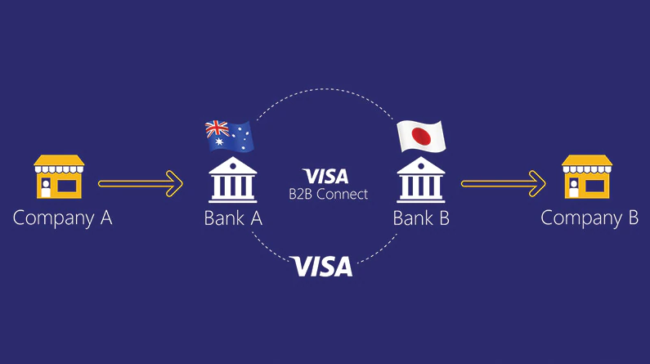

B2B Connect is a blockchain-based platform that will allow clients to make cross-border payments. With this important move, VISA is entering a brand new chapter, a new payment flow that they have never touched in the past.

Kevin Phalen, global head of Visa Business Solutions, the platform is a milestone for the company.

“With B2B Connect, we’re developing a new way for businesses to make cross border, high-value payments – fixing broken processes and breaking down geographic barriers along the way.”

Starting today, our bank clients in over 30 markets around the world will have access to Visa B2B Connect to quickly and simply make B2B payments internationally. https://t.co/Apc1j8yDDN pic.twitter.com/j6rEYW4ha1

— VisaNews (@VisaNews) June 11, 2019

He continues and says, “We’re entering into a new payment flow that Visa has never touched in the past. We’ve always been a card-based network. In this case, we’ve built a new high-value, cross-border payment network that our financial institutions can utilize for making their payments around the globe.”

It’s also worth noting that Visa B2B Connect uses tokens on IBM Blockchain in order to allow transactions from the bank of origin to the destination bank, as reported by The Daily Hodl.

Their aim is to completely change cross-border payments but it remains to be seen whether they will indeed challenge Ripple‘s solutions.